More must-read finance coverage from Fortune:

Irss stimulus how to#

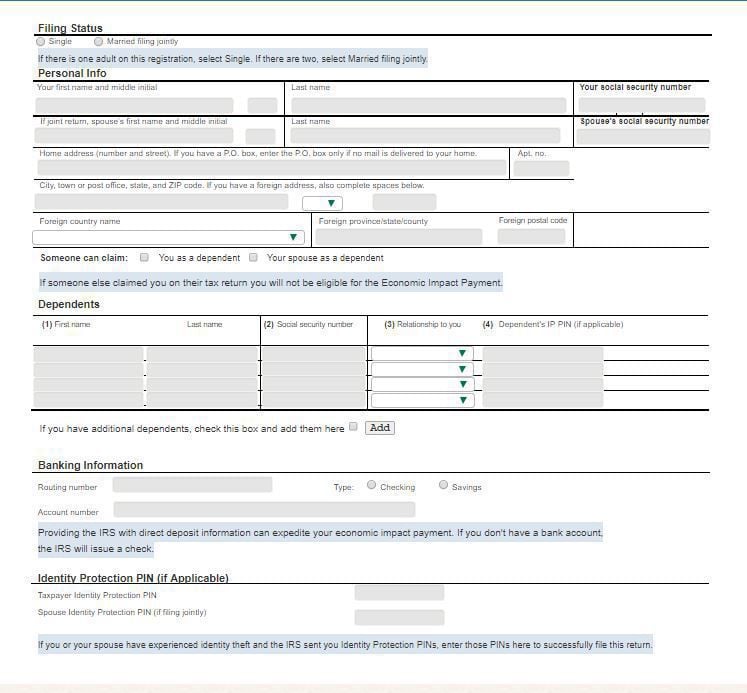

The letter will provide information on the payment, and will specify how to report any failure in receiving the payment. The IRS has also said that it plans to send a letters about direct payments to every taxpayer’s last known address within 15 days of the payment being made. If your direct deposit information was on your last tax return, that will ensure your stimulus payment comes as soon as possible.

Irss stimulus license#

Driver’s license or state-issued ID (if you have one)įor those who did file taxes recently, there is nothing further you need to do.had zero or negative federal income tax liability. IRS announced the official payment date of January 4, 2021. Initial direct deposit payments have begun to arrive and may show as pending or as provisional payment in your bank account before the official payment date.

citizens or permanent residents who had gross income that did not exceed $12,200 ($24,400 for married couples) for 2019, or “were not otherwise required to file a federal income tax return for 2019 and didn’t plan to.”Īccording to estimates from the Tax Policy Center, in 2018 44% of people in the U.S. The IRS has started delivering the second round of of Economic Impact Payments referred to as stimulus checks. While most people will automatically receive stimulus checks by direct deposit or by mail, the portal will be a way for those who did not file taxes recently to get their banking information to the government. citizens who have a valid Social Security number, could not be claimed as a dependent of another taxpayer, or had adjusted gross income under certain limits. The Internal Revenue Service, also known as the IRS, was established in 1862. In the first global hit, several countries imposed lockdowns to prevent the spread of the new coronavirus. By 2022, there will be no country in the world without coronavirus. The virus was first discovered in Wuhan, China, and later spread worldwide. Those eligible for the stimulus payments include U.S. IRS Stimulus Tracker A deadly virus hit the world and the United States in early December 2019. income taxes can submit their direct deposit information, in order to get their stimulus checks from the government as part of the CARES Act. On Friday, the IRS launched a portal where those who are not required to file U.S. After that, there will be three more child tax credit distributions - on October 15, November 15, and December 15.Update: On April 15, the IRS also launched its ‘Get My Payment’ portal for those who filed taxes to track the status of their stimulus checks Non-filers, rejoice!

Check #3, for example, is set to go out on September 15. Such as preparing to send out more rounds of child tax credit payments. In a statement issued one day before tax refunds checks were. The 18 million payments, totaling 9.5 billion, is the largest such program in the state’s history. The tax agency is completing all this, by the way, at the same time it’s busy with other important tasks. 7, the State of California Franchise Tax Board (FTB) started sending out Middle Class Tax Refunds (MCTRs) of up to 1,050 to approximately 23 million eligible residents. And it sends out checks when appropriate.

The IRS re-calculates everything on its end. For taxpayers who overpaid, the IRS will either refund the overpayment or apply it to other outstanding taxes or other federal or state debts owed.”Īgain, taxpayers don’t have to take any action on their part to receive one of the IRS unemployment refund payments. “The IRS review means most taxpayers affected by this change will not have to file an amended return because IRS employees have reviewed and adjusted their tax returns for them. “The IRS effort (is) focused on minimizing burden on taxpayers so that most people won’t have to take any additional action to receive the refund,” the agency said in a recent news release.

0 kommentar(er)

0 kommentar(er)