Average cost takes the average of the beginning inventory balance and purchases to calculate the average cost per unit. In the case of the electronics retailer, FIFO can help determine whether older inventories sold first fetched a lower price, compared to LIFO, which might indicate higher prices because of unforeseen factors or conditions such as supply constraints that pushed up costs on purchasing laptops later in time. FIFO refers to calculating inventory by selling older items first, while LIFO goes for the sale of the newest items, and either’s use depends on the company’s business strategy. There are three different popular methods used under accounting standards: first-in, first-out (FIFO) last-in, first-out (LIFO) and average cost. Selling and purchasing prices can change over time, which means using another way to calculate inventory valuation. That would be a simplified version of calculating cost of goods sold.

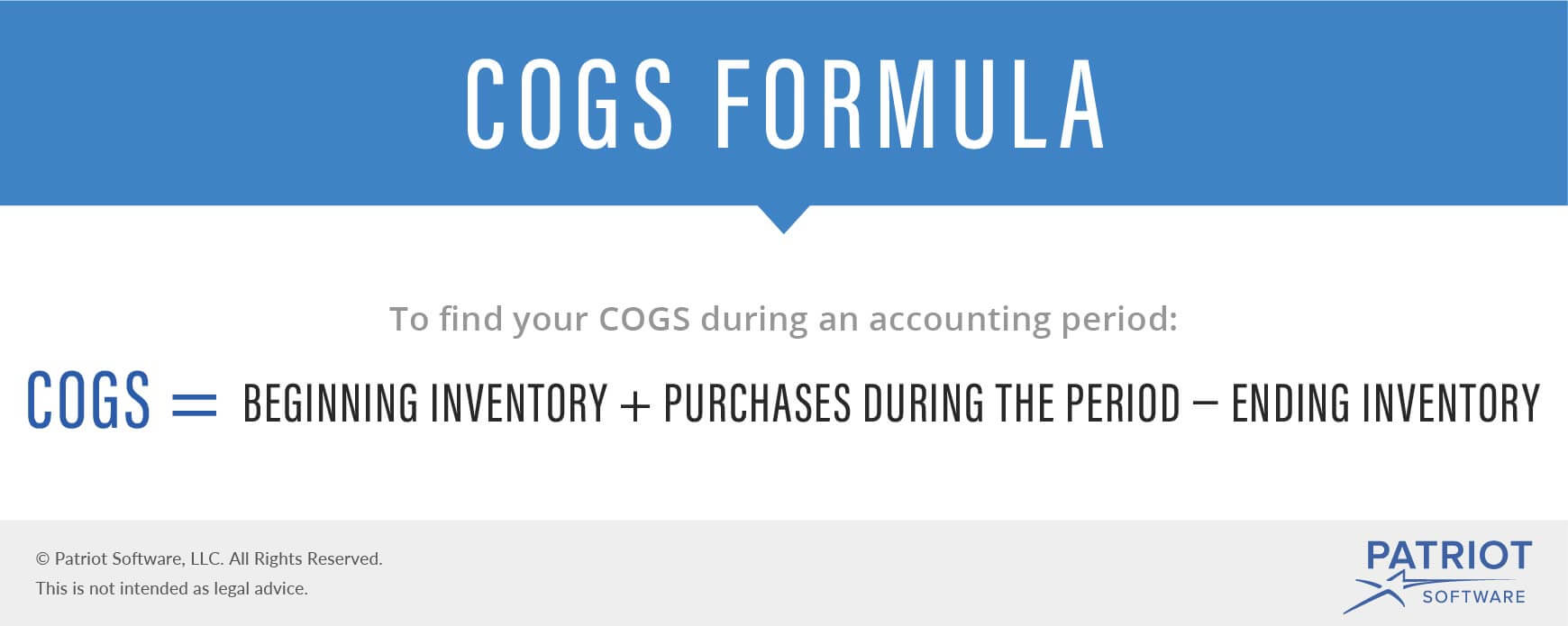

By the end of March, its inventory dropped to $8 million, indicating that-by using the above formula-its cost of goods sold amounted to $7 million. In the beginning of January, it had $10 million in laptops and purchased $5 million of units in February to further boost inventory. Let us consider a manufacturing company that needs to calculate the cost of sales based on the transaction that happened in 2020.Cost of Good Sold = Beginning Inventory + Inventory Purchases – Ending Inventoryįor example, an electronics retailer is tabulating sales of a particular brand of laptops to customers during its first quarter. You can use the following basic and simple formula for calculating the cost of salesĬost of Sales = Beginning Inventory + Inventory Additions – Ending Inventory Cost of Sales Example Adding the cost of goods manufactured/purchased to the beginning inventory and subtracting the inventory at the end.Adjusting the cost of goods manufactured/purchased by the inventory change during the given period.The Cost of Sales can be calculated in 2 different ways. Cost of acquiring/manufacturing new products.The primary components for calculating the cost of sales are What does the Cost of Sales measure?ĬOGS are used to measure the cost of goods/services provided during a period by any entity. In short, it includes the direct cost of sales like direct material & labor costs and other direct costs associated with production that has been used for producing and selling a product.Ĭost of Sales doesn’t measure indirect expenses like distribution costs & marketing costs. It involves the cost required to either manufacture goods or purchase products that shall be sold to the customers. The Cost of Sales or Cost of Goods Sold (COGS) denotes what a seller must pay for creating a product and getting it into paying customer’s hands. Companies use COGS as a measurement for calculating Gross Margin.Ĭost of Sales means an entity’s direct cost of sales.

Cost of Sales | Definition, Formula & Calculation

0 kommentar(er)

0 kommentar(er)